Contents:

If you don’t know, you can try any in the OmniCalculator Present Value tool. If you find this topic interesting, you may also be interested in our future value calculator. Keep reading to find out how to work out the present value and what’s the equation for it. The future value of an annuity is the total value of a series of recurring payments at a specified date in the future.

Investors Heavily Search APi Group Corporation (APG): Here is … – Nasdaq

Investors Heavily Search APi Group Corporation (APG): Here is ….

Posted: Thu, 13 Apr 2023 13:00:00 GMT [source]

Because we know three components, we can solve for the unknown fourth component—the number of years it will take for $1,000 of present value to reach the future value of $5,000. Our focus will be on single amounts that are received or paid in the future. We’ll discuss PV calculations that solve for the present value, the implicit interest rate, and/or the length of time between the present and future amounts. Thus, rather than using a single discount rate, one should use multiple discount rates, discounting each cash flow at its own rate. Here, each cash flow is separately discounted at the same rate as a zero-coupon bond corresponding to the coupon date, and of equivalent credit worthiness . As above, the fair price of a “straight bond” (a bond with no embedded options; see Bond § Features) is usually determined by discounting its expected cash flows at the appropriate discount rate.

Present Value of a Growing Perpetuity (g = i) (t → ∞) and Continuous Compounding (m → ∞)

The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. https://1investing.in/ our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

Shows the Excel PV function used to calculate the present value of an investment that earns an annual interest rate of 4% and has a future value of $15,000 after 5 years. For the PV formula in Excel, if the interest rate and payment amount are based on different periods, adjustments must be made. A popular change that’s needed to make the PV formula in Excel work is changing the annual interest rate to a period rate. That’s done by dividing the annual rate by the number of periods per year. That means, if I want to receive $1000 in the 5th year of investment, that would require a certain amount of money in the present, which I have to invest with a specific rate of return . Present value provides a basis for assessing the fairness of any future financial benefits or liabilities.

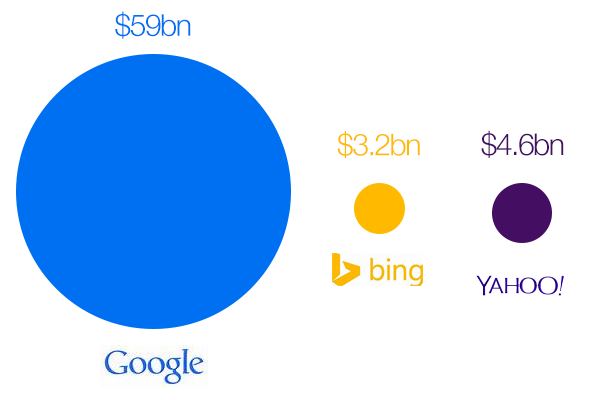

In contrast, if the interest rate is greater than 0, the future value is always greater than 1. From the graph above, the higher the interest rate, the higher the future value. In addition, the longer the period is, the higher the future value.

Present Value of an Annuity Formula Derivation

This article explains the computation of the present value of a single payment to be received at a single point of time in future. To understand the computation of the present value of a series of payments to be received in future, read ‘present value of an annuity’ article. Examples of capital budgeting techniques that take into account the present value of money are ‘net present value method’, ‘internal rate of return method’ and ‘discounted payback method’.

When you start working with time value of money problems, you need to pay attention to distinguish between present value and future value problems. One way to solve present value problems is to apply the general formula we developed for the future value of a single amount problems. Another way of looking at this is to say that because of the time value of money, you would take an amount less than $12,000 if you could receive it today, instead of $12,000 in 2years.

What is the present value of a single amount?

Given the desired future cash flow, the rate of return, and its present value, you can use the tool to determine how much time you have to leave the money compounding . Money not spent today could be expected to lose value in the future by some implied annual rate, which could be inflation or the rate of return if the money was invested. The answer tells us that receiving $5,000 three years from today is the equivalent of receiving $3,942.45 today, if the time value of money has an annual rate of 8% that is compounded quarterly. The answer tells us that receiving $10,000 five aged von today is the equates of receiving $7,440.90 today, if the time value of money has an annual rate of 6% compounded semiannually. We see that the present value of receiving $1,000 in 20 years is the equivalent of receiving approximately $149.00 today, if the time value of money is 10% per year compounded annually. The answer tells us that receiving $1,000 in 20 years is the equivalent of receiving $148.64 today, if the time value of money is 10% per year compounded annually.

Behind every multiple streams of income, calculator, and piece of software, are that mathematical equations needed to compute present value amounts, interest rates, the number of cycles, and the future value amounts. We will, at the getting, show you multiple examples of how to use the present value formula in addition to using the PV tables. Financial ModelingFinancial modeling refers to the use of excel-based models to reflect a company’s projected financial performance. The internal rate of return is a metric used in capital budgeting to estimate the return of potential investments. The big difference between PV and NPV is that NPV takes into account the initial investment. The NPV formula for Excel uses the discount rate and series of cash outflows and inflows.

Present value formula for a single payment

It supports various assets providing high returns in exchange for higher risk through multiple risk management and hedging techniques. The interest rate available on a specific investment, which he is interested in, is 4% per annum. You can think of present value as the amount you need to save now to have a certain amount of money in the future. The present value formula applies a discount to your future value amount, deducting interest earned to find the present value in today’s money. A perpetuity is an annuity in which the constant periodic payments continue indefinitely. Note that, in line with the general cash flow sign convention, the PV function treats negative values as outflows and positive values as inflows.

We obtain $620.92, the present value of $1000 in 5 years with a rate of return of 10% annually. Present value is also useful when you need to estimate how much to invest now in order to meet a certain future goal, for example, when buying a car or a home. So, if you’re wondering how much your future earnings are worth today, keep reading to find out how to calculate present value. Future value is the value of a current asset at a future date based on an assumed rate of growth over time.

Also, please note that the returned present value is negative, since it represents a presumed investment, which is an outflow. In other words, if you invested $10,280 at 7% now, you would get $11,000 in a year. The previous section shows how to calculate the present value of annuity manually. The good news is that Microsoft Excel has a special PV function that does all calculations in the background and outputs the final result in a cell. The higher the interest rate, the higher the compounded interest earned, all else equal.

This millionaire calculator will help you determine how long it will take for you to reach a 7-figure saving or any financial goal you have. You can use this calculator even if you are just starting to save or even if you already have savings. Sum all the present values, then subtract the initial investment from that sum.

- Unspent money today could lose value in the future by an implied annual rate due to inflation or the rate of return if the money was invested.

- Below is more information about present value calculations so you understand the factors that affect your money and how to use this calculator properly.

- Present Value, or PV, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate.

- A discount rate selected from this table is then multiplied by a cash sum to be received at a future date, to arrive at its present value.

- This example shows that if the $4,540 is invested today at 12% interest per year, compounded annually, it will grow to $8,000 after 5 years.

- The interest rate for discounting the future sum exists estimate at 10% per year mingled annum.

He is and sole author of all the materials at AccountingCoach.com. I have been using the videos to prepare for the CFA Level II exam. The videos signpost the reading contents, explain the concepts and provide additional context for specific concepts. The fun light-hearted analogies are also a welcome break to some very dry content.

For ordinary annuity, where all payments are made at the end of a period, use 0 for type. This is the default value that applies automatically when the argument is omitted. Please pay attention that the 3rd argument intended for a periodic payment is omitted because our PV calculation only includes the future value , which is the 4th argument. A stock pays a constant dividend of $8 at the end of each year for 20 years at a 25% required rate of return.