Contents:

Friedberg Direct offers direct access to Non-US persons to spot foreign currency, currency options and commodity futures trading through dynamic on-line trading platforms. All accounts are opened by and held with Friedberg Direct, a division of Friedberg Mercantile Group Ltd. and member of the Investment Industry Regulatory Organization of Canada . With over 20 years of supplying trading accounts and services to thousands of traders in Canada, Friedberg Direct seems to have their fair market share. Questrade is an online trading platform that was founded in 1999. The company has over $25 billion of assets under management . The company offers a wide variety of tradable securities, from stocks to ETFs to forex and many more.

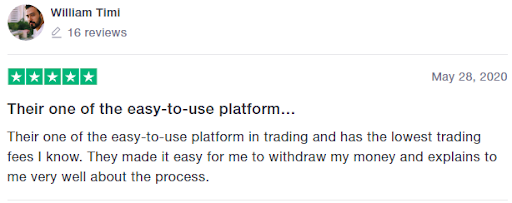

We also ensure all reviews are published without moderation. We use dedicated people and clever technology to safeguard our platform. As a client-oriented broker, we are always happy to read feedback like yours. If you ever want to share any preferences or suggestions, we’d love to hear you out. It’s positive for investors that the broker FXCM may be a member of the so-called Financial Services Compensation Scheme, British deposit insurance. It’s interesting that there’s also a decent selection for traders with regard to order execution.

The company does not have a physical office within Canada and defers clients to its office address in the US. Similar to other platforms, forex traders from Alberta will have to be classified as accredited investors. The Ontario court also approved Class counsel’s disbursement request and a portion of the fee request.Please click here to review the Reasons for Decision. Operating through the IIROC-regulated Friedberg Direct, FXCM offers forex, indices, and commodity trading on margin. You can deposit using a credit card, debit card, or with a bank wire transfer. Withdrawals can also be made back to your credit or debit card, up to the amount initially deposited.

Dome Productions upgrades to 4K HDR

This means that when funds are dwindling on their accounts, they will be more likely to seek ways to boost operations using client money. This is an extremely bad business practice, and in the event that the broker cannot meet their financial obligations, your funds will be tied up with theirs and could even be claimed by their creditors. This is probably the most not-so-subtle scam, but it still manages to net customers. In this scam, investors are encouraged to join a service or company that trades the Forex market, and they will earn fixed periodic profits. This is a pure scam because the Forex market is fast and dynamic. Profits and losses are part of Forex trading and cannot be forecasted.

- June 30, 2017 The Bank of Tokyo Mitsubishi UFJ, Ltd., Bank of Tokyo-Mitsubishi UFJ (collectively, “BTMU”) entered into a formal settlement agreement whereby BTMU agreed to pay CAD$450,000.

- In case the above is not exactly what you actually looking to have, please always let us know via Live chat.

- Educating customers and providing high customer service quality is important to the long term success of online brokerage platforms.

- There is also ‘stop hunting’, where the broker will seek to take out the stop loss applied by the investor before continuing to stream the correct prices.

- This is a great way for investors looking to buy commission-free ETFs regularly, such as investing a portion of their paycheck, or those who want to automatically invest frequently.

Great technical analysis research tools, rivaling even bigger brokers out there. Really appreciate how they lay out the straightforward fee structure, and not leave the trader guessing what they need to pay. Intend on using FXCM however as inactivity will lead to a fee down the road. A broker-neutral service, executing strategies while minimizing market impact, reducing transactions costs, and monitoring risk. 77% of retail investor accounts lose money when trading CFDs with this provider.

Your feedback matters

For both passive and active investors, both Questrade and TD Ameritrade can be beneficial since both have no fees on many ETFs and stocks. Basing the platform you choose on your investment strategy and goals will help you decide the right platform. Oanda offers a decent range of CFD trading options, of which 70 are foreign exchange pairs.

Using leverage requires traders to maintain a minimum margin in their accounts and can lead to losses that are greater than the entire value of the account. The platform also has an active trader program designed for individuals that trade very high volumes. The requirements are a minimum balance of $25,000 and at least $50 million traded on a monthly basis.

GLOBAL FOREX AWARDS 2022 Best Forex Trading Platform – MENA

Our team is always happy to help, and we always appreciate when our clients make the interaction mutually pleasant. However, if I can recommend, the demo account should stay active as long as there is equity to trade with Since learning involves good and bad trades. In the bonus area, the broker FXCM isn’t necessarily convincing because, unlike many other brokers, there’s no regular bonus on the first deposit. The actual fact that the broker doesn’t actively advertise a bonus doesn’t necessarily mean that no customer has the chance to receive a bonus on the primary deposit.

The Ontario and Quebec Courts approved a method for disseminating the settlement funds achieved pursuant to previous settlements (the “Distribution Protocol”). The deadline to apply for settlement benefits expired on January 15, 2020. The Courts previously approved a method for disseminating the settlement funds achieved pursuant to previous settlements (the “Distribution Protocol”).

Interactive Brokers provides one of the lowest-cost forex trading platforms in Canada. The platform does require an account minimum opening balance. All the trading accounts are covered by the Canadian Investor Protection Fund. The company offers trading services to customers on a range of financial instruments; FX indices and commodities. Trading can be executed via FXCM’s proprietary retail trading platform, the Trading Station, available for desktop, web and mobile devices, the classic MT4 Metatrader and the Ninja Trader platform.

Just like the other banks, only Canadian and U.S. equities and options are offered. You will need to use another brokerage to access foreign markets. TD charges a flat $9.99 commission on all Canadian and U.S. stock trades.

Be sure to check these claims and not simply invest blindly. Qualified Fund Managers – Establish that the fund managers are licensed, regulated, qualified and experienced. Many scam funds will claim that their fund managers are licensed, regulated or qualified professionals but in fact, https://broker-review.org/ they are not. Technology has literally democratised the Forex market, and there are almost no barriers to entry in the retail scene. Customer support – Friedberg Direct shares FXCM’s multi language customer support. The service is available 24 hours, 5 days a week, in 21 languages.

With no minimum deposit, TD Ameritrade is a great discount broker for beginner investors who don’t want to come up with a large sum to begin their investment journey. TD Ameritrade offers an extensive selection of asset classes, market data and research tools, and educational material for self directed investing. Ranked as one of the highest customer service quality scores in the Canadian investment industry, Questrade’s client service team is available through email, and online chat. Questrade also has a dedicated number to call for any questions a self-directed investor may have. Given the impact these fees have on your investment profits, it is important to research which online brokerage is suitable for your needs.

Min Deposit $50

The Applicants will only offer CFDs and OTC FX Contracts to Ontario-registered investment dealers. The Applicants wish to offer CFDs and OTC FX Contracts solely to Ontario-registered investment dealers. FXCM US provides online trading to investors in OTC FX Contracts. Dr Gaurav Luthra, chief of cataract and refractive surgery in Drishti Eye Institute reviews Sony’s latest microscopic camera and monitor. Robust educational material on market data and market insights for beginner investors.

On top of all this, IB has some of the lowest margin rates in the industry. This means that you can borrow money to invest and trade at low interest rates. There’s also no minimum account balance or inactivity fees for individuals. If you want to trade online, it is vital to avoid scams by only trading via regulated brokers, with a long track record, impressive reputation, industry awards and high client satisfaction. When you are trading with Friedberg Direct, you are trading with a reliable and trustworthy partner that is very much invested in your success as you are.

FX active accounts allow you to access a low trading commission of 0.0025% per transaction, which is charged upfront when opening and closing trades. Traders from Alberta will have to be classified as accredited investors to use the platform. The motion to approve the Goldman Sachs, JPMorgan and Citi settlements, and class counsel’s request for fees, in Ontario is scheduled for April 13, 2017 and in Quebec on May 2, 2017. The Ontario court has approved a notice of certification for settlement purposes which, among other things, explains what steps someone can take if they object to the settlement. The motion to approve the BMO settlement, and class counsel’s request for fees and reimbursement of its disbursements, in Ontario is scheduled for July 16, 2020, and in Quebec is scheduled for August 7, 2020.

Please click here to review a copy of the Settlement Agreement. BMO’s 5 Star Program gives discounted pricing for active traders or for those with large account balances. You can qualify for the first 5 Star membership level by making between 15 to 74 trades in a quarter, or if you invest at least $250,000. 5 Star membership gives you the ability to receive free real time quotes with BMO Market Pro, dedicated support lines, and a professional investing platform. CIBC Investor’s Edge offers the lowest commissions out of the major banks, with the exception of National Bank’s commission-free trading. Stock and ETF trades with CIBC Investor’s Edge only cost $6.95 per trade, a discount to the usual $9.95 at other banks, while option trades cost $6.95 plus $1.25 per contract.

MetaTrader have a lot of robots available for Canadian traders. In addition, Questrade’s lower-than-average trading fees on stocks and other securities are a great way to trade stocks without breaking the bank. A Questrade account is a great choice fxcm canada review for those looking for self-direct investing options. Both online brokers offer a wealth of research tools and excellent customer service. With so many similarities and differences, let’s dive into both platforms for an in-depth review.